About Frost Pllc

About Frost Pllc

Blog Article

What Does Frost Pllc Do?

Table of ContentsA Biased View of Frost Pllc5 Simple Techniques For Frost PllcAll about Frost PllcThings about Frost PllcThe Definitive Guide to Frost Pllc

CPAs are among the most relied on occupations, and completely factor. Not just do CPAs bring an unequaled degree of knowledge, experience and education to the process of tax planning and managing your money, they are specifically educated to be independent and unbiased in their job. A certified public accountant will assist you secure your passions, listen to and address your issues and, similarly important, give you peace of mind.In these essential moments, a CPA can use greater than a general accountant. They're your trusted advisor, ensuring your business stays financially healthy and balanced and lawfully secured. Employing a regional certified public accountant firm can favorably impact your organization's economic health and success. Below are 5 essential advantages. A neighborhood CPA company can help in reducing your organization's tax obligation worry while making sure compliance with all appropriate tax regulations.

This growth shows our dedication to making a favorable impact in the lives of our customers. When you work with CMP, you end up being component of our family.

The Single Strategy To Use For Frost Pllc

Jenifer Ogzewalla I have actually worked with CMP for a number of years currently, and I have actually actually appreciated their knowledge and efficiency. When auditing, they work around my routine, and do all they can to preserve continuity of workers on our audit. This conserves me energy and time, which is invaluable to me. Charlotte Cantwell, Utah Festival Opera & Musical Theater For much more inspiring success stories and comments from local business owner, go here and see how we've made a difference for services like yours.

Below are some key questions to lead your decision: Inspect if the CPA holds an active permit. This assures that they have actually passed the necessary examinations and fulfill high moral and professional standards, and it shows that they have the certifications to manage your financial matters properly. Validate if the CPA provides solutions that align with your service demands.

Small organizations have unique economic demands, and a Certified public accountant with relevant experience can give more customized advice. Ask about their experience in your sector or with organizations of your dimension to ensure they understand your particular challenges.

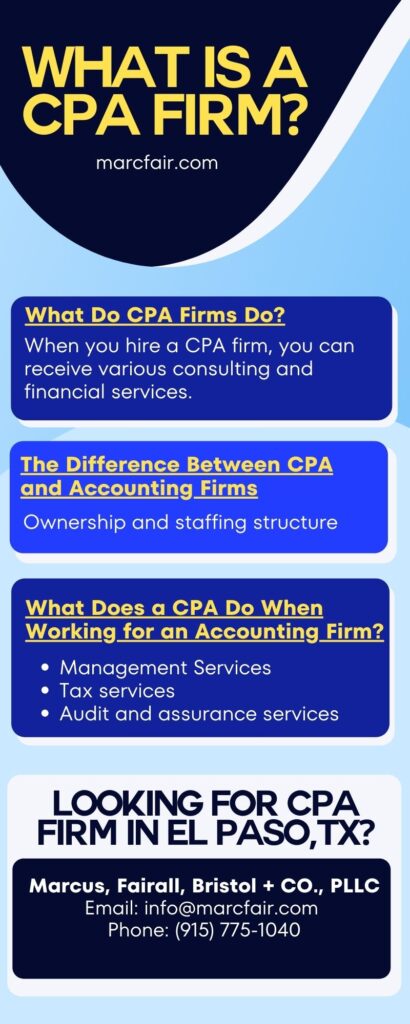

Working with a regional Certified public accountant firm is even more than just contracting out monetary tasksit's a clever financial investment in your organization's future. CPAs are accredited, accounting experts. CPAs may work for themselves or as component of a company, depending on the setup.

Some Known Details About Frost Pllc

Tackling this obligation can be an overwhelming task, and doing glitch can cost you both economically and reputationally (Frost PLLC). Full-service CPA companies recognize with filing needs to ensure your organization abide by government and state legislations, along with those of financial institutions, investors, and others. You might need to report extra revenue, which might need you to submit a tax obligation return for the very first time

CPAs are the" big guns "of the audit market and usually do not handle day-to-day accountancy tasks. Often, these other kinds of accountants have specializeds across areas where having a CPA permit isn't required, such as administration accountancy, not-for-profit bookkeeping, expense accountancy, federal government bookkeeping, or audit. As an outcome, utilizing an accountancy services business is typically a far better worth than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial management monetary.

Brickley Wide Range Management is a Registered Investment Consultant *. Advisory services are only supplied to customers or prospective customers where Brickley Wide range Management and its agents are effectively accredited or excluded from licensure. The info throughout this site is entirely for educational objectives. The web content is developed from sources believed to supply precise information, and we perform reasonable due persistance review

nonetheless, the details included throughout this web site is subject to change without notice and is not cost-free from mistake. Please consult your investment, tax obligation, or legal consultant for aid concerning your private circumstance. Brickley Wealth Management does not offer legal suggestions, and absolutely nothing in this web site will be construed as lawful recommendations. For even more details on our company and our advisors, please see the most recent Kind ADV and Component 2 Brochures and our Client Relationship Recap. The not-for-profit board, or board of supervisors, is the lawful governing body of a not-for-profit company. The participants of a not-for-profit board are responsible for understanding and applying the legal requirements of a company. They additionally concentrate on the high-level method, oversight, and responsibility of the company. While there are many prospects worthwhile of joining a board, click here to read a CPA-certified accountant brings a distinct skillset with them and can work as an important resource for your not-for-profit. This direct experience gives them understanding into the habits and methods of a solid supervisory team that they can after that show the board. Certified public accountants also have knowledge in developing and improving business plans and treatments and assessment of the functional needs of staffing designs. This provides the distinct skillset to assess monitoring groups and browse around here use referrals. Key to this is the capacity to recognize and interpret the nonprofits'yearly economic declarations, which offer insights right into how an organization produces income, just how much it costs the company to run, and how successfully it manages its donations. Often the financial lead or treasurer is tasked with managing the budgeting, forecasting, and evaluation and oversight of the monetary details and monetary systems. One of the advantages of being an accountant is working closely with members of several companies, including C-suite execs and other choice manufacturers. A well-connected CPA can utilize their network to help the company in different critical and consulting functions, efficiently connecting the organization to the optimal prospect to fulfill their needs. Next time you're aiming to fill a board seat, consider getting to out to a CPA that can bring value to your company in all the means noted above. Intend to find out more? Send me a message. Clark Nuber PS, 2022.

Report this page